My blog Analyses the trend and patterns of stocks, Futures, Commodities and Forex Markets

October 31, 2014

RELIANCE Industries chart analysis

- Reliance industries heading into a resistance line and daily cloud.

- Price need to sustain above 50 day sma to extend this up move.

- Clearing 1010 - 1015 levels on closing basis may give bigger up moves. Weakness at the resistance line may lead to a correction

SILVER Testing recent lows

- Silver daily getting resisted near 50 Day SMA

- Hour chart shows a range breakdown.

- sometimes before a big reversal a false spike below the recent low is possible. If daily does not give a lower close there is hope for silver bulls. But for now it remains a hope for those who were long.

- All major time frames remain in favor of bears.

- SILVER TREND UPDATE

October 30, 2014

October 29, 2014

Bank Nifty Chart analysis

- Weekly and Daily are testing resistance lines. But no alarms for Bulls yet as price is not showing weakness.

- Positional support for BN is around 16220 - 16260 region and the GAP as shown in second chart.

- Daily MACD is showing negative divergence. But both MACD and Price yet to show sell signals.

- CRUDE OIL MONTHLY Chart analysis

- SILVER TREND UPDATE

October 28, 2014

CRUDE Oil trend update

- The Month time frame is shown with Fibonacci levels. It shows a broad range between 38.2% and Golden ratio. So this is roughly between 74 - 77 to 103 - 112. Price right now is testing the bottom of this range.

- Second chart is the weekly time frame with possible support levels.

- Ichimoku cloud of Daily Time Frame will act as shield for Crude oil bears.

- 4 Hour time frame shows a bearish Descending triangle pattern. Mostly acts as a trend continuation pattern.

- Crude oil bulls must hope for a Basing formation around 74 - 77 for a possible up move to happen.

- EURUSD Trend Update

- SILVER TREND UPDATE

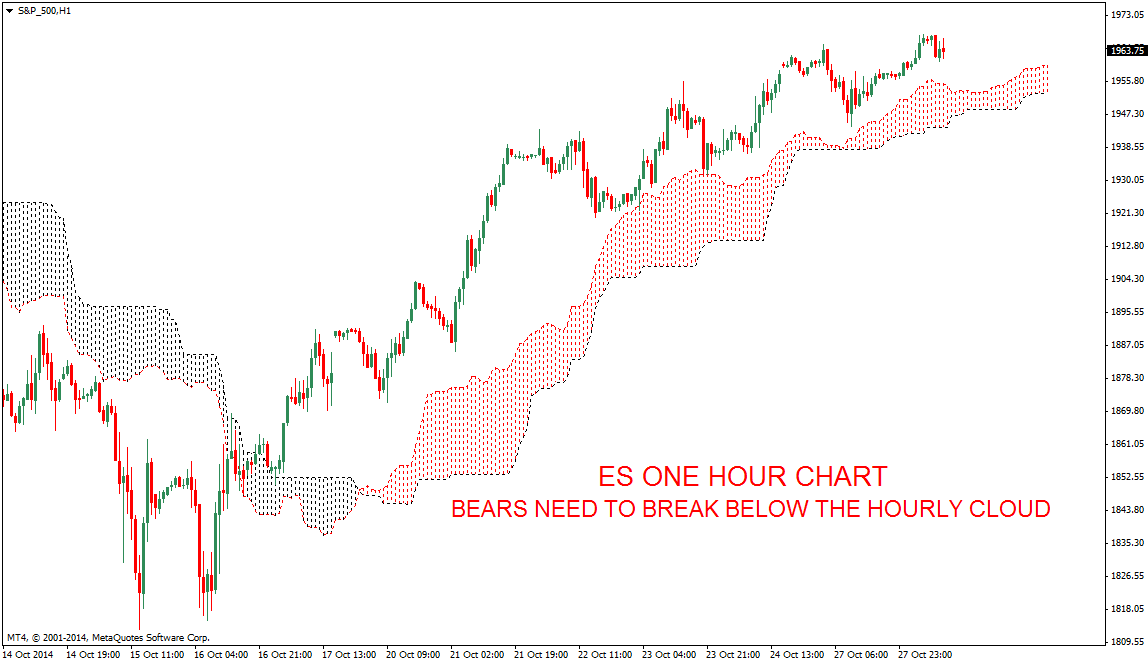

S&P 500 Futures chart analysis

- ES Higher time frames are showing price at a crucial support resistance zone.

- Hourly charts are showing a nice trending move favoring bulls, That may end if the daily TF Fails to make a bullish close above 50 Day SMA. First chart also shows price testing a crucial support resistance zone.

- For the very short term price must stay above the Hourly cloud for bulls to extend this up move.

- EURUSD Trend Update

October 27, 2014

SILVER Trend update

- Silver Month week and Day time frames shows strong down trend.

- Daily time frame will continue to favor bears as it stays below 50 and 200 Day SMA.

- GOLD WEEKLY SUPPORT ZONE

EURUSD Trend update

- First chart shows the Monthly time frame which is near a support band between 1.20 - 1.25.

- Weekly chart shows a Bearish flag breakdown with possible target of 1.20 levels. Weekly close below 1.20 will further extend the down trend.

- Daily chart too shows the Ichimoku cloud as strong resistance. Any possible bounce only on price staying above the cloud.

October 14, 2014

GOLD Weekly support zone and Trend update

- Gold Weekly chart shows price trying to find support near the 1180 levels.

- Daily chart is yet to clear 50 Day SMA. Unable to move above this level and 200 SMA may lead to further falls.

- 4 Hour and One hour charts are trying to stay above the cloud. Price staying above 4 Hour cloud will give hope for Gold bulls.

Subscribe to:

Comments (Atom)