My blog Analyses the trend and patterns of stocks, Futures, Commodities and Forex Markets

February 27, 2013

ES Fibonacci levels

- First chart shows hour chart with the recent fall from 78.6% Fib level

- Second chart shows resistance levels for the current up move with 200 Hour SMA near Golden ratio.

- Last chart shows same fib levels shown in second chart but with 4 Hour time along with Ichimoku cloud. Confluence of resistance at 4 Hour cloud the Golden ratio and 200 Hour SMA may try to stop bulls from making a bigger up move.

SLV Chart analysis

- SILVER Daily MACD is Aligning for a bounce towards the resistance line shown in the chart.

- But bulls of slv is approaching resistance levels in 38.2% Fib level and previous support level which may also act as resistance.

- Unable to stay above 23.6% Fib level may lead to a retest of the recent lows again.

NIFTY Support and Resistance levels

HOURLY FIBS

- Daily chart shows the bounce from golden ratio.

- 2nd chart shows the neck line and 100 Day SMA as resistance.

- Hourly chart shows immediate resistance levels.

- BANK NIFTY CHART ANALYSIS

BANK NIFTY Weekly chart analysis

- Bank nifty falling from a head and shoulders pattern.

- 2nd chart shows a possible support level.

- Last chart shows price moving towards the rising support line from 9110. For price to test the support line fall has to be deeper, BN has to fall another 400 points to reach the support line.

- HINDALCO CHART ANALYSIS

HINDALCO Chart analysis

- Hindalco continues to fall in a straight line.

- Price is near crucial support levels.

- Weekly indicator is at oversold levels But yet to show signs of reversal there could be more falls if price breaks 100 level

- Last chart shows the possible target for the current fall.

- BANK NIFTY CHART ANALYSIS

ES Resistance levels

- First chart the 4 Hour time frame shows price getting resisted at 200 period SMA.

- One hour chart shows the resistance at previous support level and Fib level shows the same at 38.2% Fib level.

- 4 Hour close above 200 period SMA should lead to a bigger pullback. Testing the lows could lead to an extension of the fall.

- GBPUSD CHART ANALYSIS

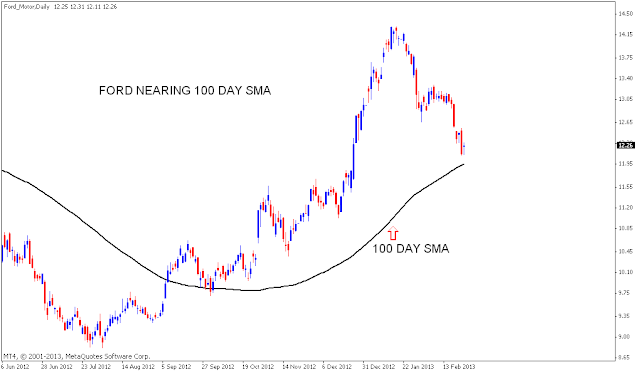

FORD Motor Chart analysis

- Ford Motor in a descending channel and price approaching the up trend line as shown in the first chart.

- Second chart shows price falling towards 100 Day SMA. Last chart shows price testing 38.2% Fib level.

- This correction is likely to end at the up trend line or 100 Day SMA and a Bounce towards 23.6% Fib level is likely to happen.

- EURUSD CHART ANALYSIS

Subscribe to:

Comments (Atom)